Facebook effectively beat gauges for income and benefit for its second from last quarter, however confronted indications of stress from financial specialists that the organization’s development is backing off.

The organization proceeded with its noteworthy development streak, reporting $7 billion (generally Rs. 46,699 crores) in income in a quarter surprisingly, which bested the desires of most examiners who anticipated the online networking goliath would produce $6.92 billion. Considerably all the more astounding, the organization’s benefits were vastly improved expected with income $1.07 per share versus a normal 97 pennies.

Be that as it may, even these wonderful astonishments didn’t appear to cheer financial specialists. In the wake of shutting at $127.17, Facebook offers tumbled more than 2.7 percent quickly after the report in night-time exchanging. The stock soon made an unassuming recuperation and was just about even with the market near to the organization’s income call with financial specialists around 5pm.

A portion of the auction may have been on account of Facebook’s income grew 56 percent year-over-year – a somewhat slower pace than what the organization had reported previously. Last quarter, the interpersonal organization reported it had grown 59 percent from a similar time the earlier year.

Still, Facebook is solid on the basics of its business. The organization keeps on building its client construct, especially with respect to cell phones. The organization said that this quarter, without precedent for its history, it had more than one billion month to month dynamic portable clients.

Facebook now gets 84 percent of its promoting income from cell phones, a basic metric in an inexorably remote age. Generally, Facebook said it now has in regards to 1.8 billion month to month dynamic clients.

Obviously, the informal organization is only a part of what Facebook does. The tech firm made it clear that it has its eye on a much more extensive and longer timetable. “We had another great quarter,” said Facebook CEO Mark Zuckerberg in an announcement. “We’re gaining ground putting video first over our applications and executing our 10 year innovation guide.”

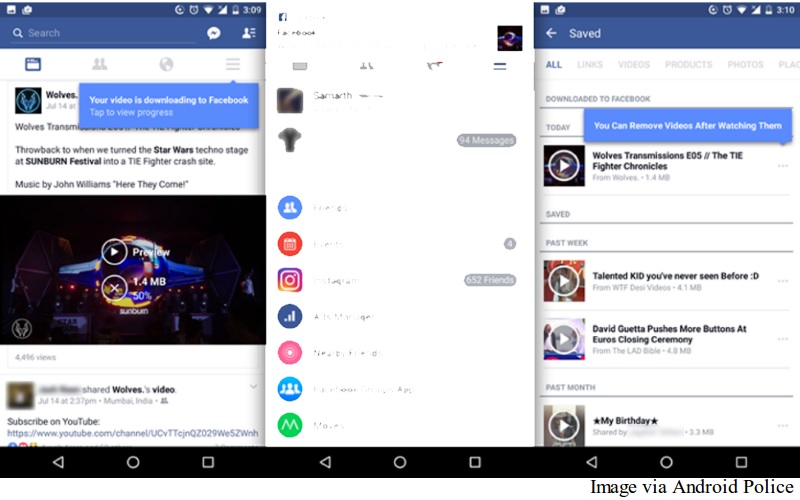

The organization is sinking parcel of speculation into video, both through promotion innovation and its late push to get clients and organizations to live-stream occasions through its system.

That hasn’t been a totally smooth street. The organization as of late conceded that it had miscalculated video activity in a way that could have expanded perspectives by as much as 60 to 80 percent, as per a report in the Wall Street Journal a month ago. Facebook has since amended its mistake. Be that as it may, the issue dazed the publicizing scene.

Long haul speculations from Facebook extend from its virtual reality Oculus Rift headset, to its proceeded with work out of WhatsApp and other informing projects, to its armada of automatons that give Internet access to provincial ranges the world over.

A few examiners cautioned that it will require investment for Facebook’s numerous ventures to pay off.”We are apprehensive on the transient standpoint for Facebook as market evaluations are accepting that incomes emerge from the new biological system benefits much sooner than we consider them to be being full sufficiently grown to create income,” said Richard Windsor, an expert at Edison Investment Research in a note to financial specialists. “We stay fleeting mindful on Facebook notwithstanding the way that it has a considerable measure of long haul potential. There will be a superior time to get in.”